INTRODUCTION

Money is something we use every day, but how much do we really know about where it comes from? For us in Ghana, our currency has a rich and fascinating history that tells the story of how far we’ve come as a nation. From the days when people traded goods like gold, salt, and kola nuts, to the sleek notes and coins we carry in our wallets today, the journey of the Ghanaian currency is anything but straightforward.

What makes it even more interesting is how closely the story of our money is tied to Ghana’s larger story as a country. It reflects our struggles, our victories, and even the tough lessons we’ve had to learn about managing our economy. Did you know, for instance, that there was a time when our cedi was so devalued that people carried bags of cash just to buy basic items? Imagine walking into a shop with stacks of notes just to purchase a loaf of bread!

How the Cedi Evolved

But it hasn’t always been this way. Our currency has evolved, sometimes for the better and other times under very difficult circumstances. From the first Ghanaian pound introduced after independence, to the many changes we’ve made since then to keep up with the times, each step reveals something about us as a people.

In this blog post, we’re going to dive deep into the history of the Ghanaian currency—how it started, the twists and turns it has taken, and what it says about where we’re headed as a nation. Whether you’re curious about why we switched from the pound to the cedi or you want to understand why we’ve had to redenominate our money multiple times, this is your chance to learn it all.

By the time you finish reading, you’ll not only know the story of our currency but also appreciate why it matters so much. Let’s get started.

Pre-Colonial Era: Barter and Trade

Before coins and paper money, people in what we now call Ghana had their own unique ways of doing business. Imagine living in a world where there was no cash or even a fixed price for goods. If you wanted something, you had to offer something else in return. This system was known as barter trade.

Let’s paint a picture. Say you were a farmer with plenty of yams, but you needed fish. You’d go to the fisherman, and the two of you would agree on how many yams were worth a basket of fish. But what if the fisherman didn’t need yams? Or what if you thought your yams were worth more than he thought? That’s where the barter system became tricky—it relied on both parties wanting what the other had and agreeing on its value.

Common Items Used in Barter

To make trade easier, people started using items that almost everyone valued. Gold was one of those items, and it played a huge role in our trade. Ghana, or the Gold Coast as it was later called, was blessed with an abundance of gold. Traders from the north, south, and across the Sahara flocked to our lands because they knew they could get gold here. This made gold not just a symbol of wealth but also a reliable way to trade.

But gold wasn’t the only thing people used as a medium of exchange. Cowries, which are small, shiny shells, were also widely used. These shells came from the Indian Ocean and were highly prized, not just here in Ghana but across West Africa. People carried them in bags, counted them, and used them to buy and sell goods. It’s hard to believe now, but these little shells were once considered valuable enough to buy a house or even pay a bride price.

Salt was another major item in the trade system, especially in the northern parts of the region. Known as “white gold,” salt was essential for preserving food in a time before refrigeration. The people in the north had access to salt mines, and they traded it with southern communities for items like kola nuts and palm oil.

What makes this era so fascinating is how resourceful our ancestors were. They didn’t have banks or currencies as we know them today, but they found ways to trade and build thriving economies. However, as more people came into contact with different cultures—especially through trans-Saharan trade routes—things started to change.

The Influence of Foreign Merchants

Foreign merchants brought new goods like cloth, beads, and spices, but they also introduced the idea of standardized currency. This marked the beginning of a shift from barter to money-based trade. But even as currencies like the cowries gained popularity, the value of gold in Ghana remained unmatched.

So, while our ancestors didn’t use cedis or dollars, their trade systems laid the foundation for the Ghanaian economy we know today. They showed us that wealth isn’t just about money—it’s about resources, creativity, and the ability to adapt. Little did they know that their gold and shells would eventually pave the way for the currency journey we’re about to explore.

The Colonial Era: Introduction of Foreign Currency

The story of Ghana’s currency takes an intriguing turn during the colonial period, when our land was controlled by the British. It was a time when foreign currencies replaced the traditional systems of trade we’d relied on for centuries, and with it came both opportunities and challenges that shaped the economy of the Gold Coast.

Gold Coast Adopts the British Pound

When the British established full control over the Gold Coast in the late 19th century, they brought with them their currency—the British pound. The pound wasn’t just any currency; it was one of the strongest in the world at the time. Coins and notes in pounds, shillings, and pence became the official medium of exchange, and these foreign currencies slowly pushed out our traditional trade items like cowries and gold dust.

At first, the transition wasn’t easy for many locals. Think about it: you’ve grown up trading goods or using gold that you could physically see and feel its value, and suddenly you’re being told to trust a piece of paper or a coin stamped with the face of a foreign king or queen. It took time for people to accept the new system, but as trade expanded and the British introduced formal markets, the pound became unavoidable.

The Role of the West African Currency Board (WACB)

In 1912, the British established the West African Currency Board (WACB). Its job was to issue currency for all British colonies in West Africa, including the Gold Coast. This was a big deal because, before the WACB, the Gold Coast had to rely directly on Britain for its money supply, which often caused delays and shortages.

The WACB issued coins and notes specifically designed for use in West Africa. These currencies were backed by the British pound sterling, which means they had real value because they could be exchanged for British pounds. This system was supposed to make trade between the colonies and Britain smoother.

But here’s the catch: while the WACB made it easier to use money in the Gold Coast, it also tied our economy very tightly to Britain’s. The prices of our goods—like cocoa, which was becoming our main export—were heavily influenced by decisions made in London, not here at home. This dependence on foreign control would later become a source of frustration for many Ghanaians.

Colonial Currency and Inequality

While the British pound and WACB-issued currency were great for merchants and colonial administrators, they didn’t benefit everyone equally. Many rural farmers and traders were still excluded from the formal economy because they couldn’t easily access the new money. In some cases, people continued to use gold dust or barter for years, even though these were no longer officially recognized.

This division created a strange reality: in the cities and coastal areas, where the British influence was strongest, the pound dominated. But in the villages and remote areas, traditional systems of trade held on stubbornly. It was almost like two economies existed side by side, a reflection of the growing inequality under colonial rule.

The Path to Change

The colonial era planted the seeds of Ghana’s future currency system. It introduced the idea of centralized currency control, formalized trade, and banking systems. But it also exposed the risks of relying too much on foreign powers to manage our money. By the time Ghana was moving towards independence, there was a growing desire for a currency that truly represented us as a people—not just as another colony.

As independence drew closer, the stage was set for one of the most significant financial changes in our history: the creation of the Ghanaian pound. This move would mark the beginning of our journey to economic self-determination.

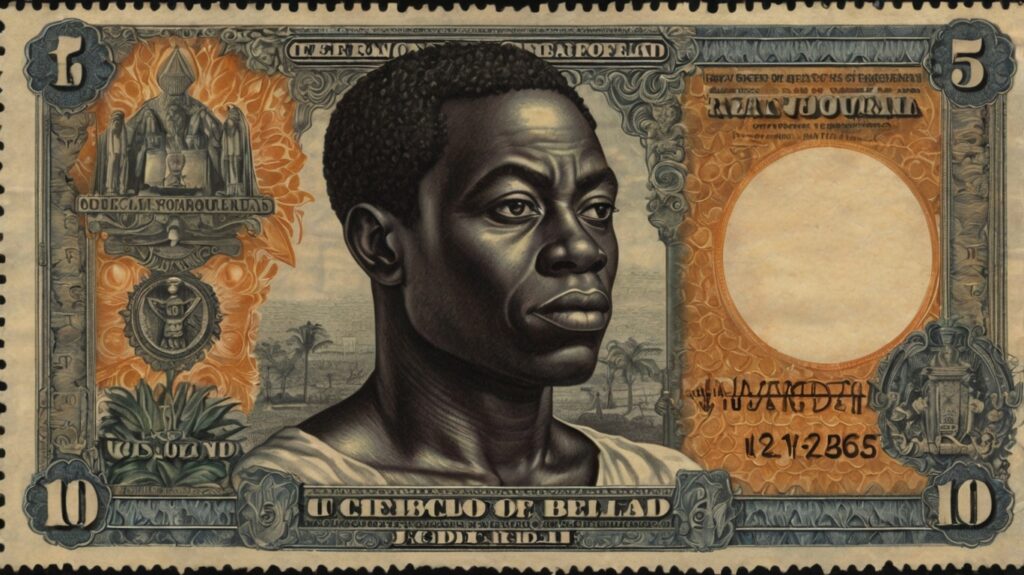

Independence and the Birth of the Ghanaian Pound (1958)

By 1957, Ghana had made history as the first country in sub-Saharan Africa to gain independence from colonial rule. But independence wasn’t just about waving a new flag or singing a new anthem—it was about taking control of every part of our nation, including our economy. For a country that had been under British control for decades, using the British pound didn’t feel right anymore. We needed a currency that would reflect our identity and independence.

So, in 1958, Ghana made a bold move: we introduced our very own currency, the Ghanaian pound. This was a monumental step—not just for our economy, but also for our national pride. However, as with every major change, this decision came with challenges and surprising twists.

Why the Ghanaian Pound?

At first glance, you might wonder: why did Ghana choose to create a currency so similar to the British pound? After all, the new Ghanaian pound used the same system of pounds, shillings, and pence that the British had introduced. The answer lies in practicality. Ghana was still closely tied to Britain through trade and financial systems, so maintaining a currency linked to the pound sterling made sense at the time. It allowed businesses and banks to adjust to the new currency without major disruptions.

But the Ghanaian pound was more than just a copy of the British pound. It was a statement—a way of saying, “We may still trade with you, but this currency is ours.” The notes and coins were designed with Ghanaian symbols, showcasing our rich culture and heritage. For the first time, our currency was something we could truly call our own.

The Challenges of Transition

Switching from the British pound to the Ghanaian pound was no small task. Imagine an entire nation having to learn about a new currency—what it looked like, how it worked, and how to exchange the old money for the new. The government had to launch a massive public education campaign to make sure people understood the change.

There were also logistical hurdles. Printing and distributing the new currency took time and resources, and the government had to ensure that everyone, from the bustling markets in Accra to the remote villages in the north, could access the new money.

Some people were skeptical. After all, the British pound had been a trusted currency for decades. Would this new Ghanaian pound hold its value? Would it be as strong and reliable? These were real concerns, especially in a world where currencies from newly independent countries were often viewed as weak.

Symbolism and Pride

Despite the challenges, the introduction of the Ghanaian pound was a moment of immense pride. The new notes and coins featured symbols of our culture and achievements, such as images of cocoa—a nod to our status as one of the world’s leading cocoa producers—and traditional Ghanaian motifs.

For many Ghanaians, holding the Ghanaian pound for the first time was a powerful experience. It wasn’t just a piece of paper or metal; it was a symbol of freedom and self-determination. It reminded people that Ghana was no longer under British rule—we were now in control of our destiny.

The Beginning of Economic Independence

However, the introduction of the Ghanaian pound was only the beginning of our journey toward economic independence. Ghana still faced many challenges. Our economy was heavily reliant on exports like cocoa, and fluctuations in global prices could affect the value of our currency.

Additionally, the Ghanaian pound was still tied to the British pound sterling, which meant that decisions made in Britain could still impact our economy. This dependence would later lead to calls for even greater financial autonomy, setting the stage for the introduction of the cedi in 1965.

The Introduction of the Cedi (1965)

By 1965, Ghana was nearly a decade into independence, and the euphoria of freedom had begun to give way to the harsh realities of nation-building. One of the pressing issues was the need to fully break away from colonial influences, not just politically but economically as well. The Ghanaian pound, which had served as the country’s currency since 1958, still operated on a system tied to British traditions: pounds, shillings, and pence. This connection felt increasingly outdated and out of place in a country striving to carve out its own path.

Something had to change, and that change came in the form of the cedi. The decision to introduce a new currency wasn’t just about practicality—it was a bold statement of Ghana’s commitment to economic independence and modernization. But as we’ll see, the transition wasn’t without its share of twists and challenges.

Why the Switch from the Pound?

The decision to replace the Ghanaian pound with the cedi was driven by several factors. First, the British-inspired currency system was complex and confusing for many Ghanaians, especially those in rural areas. Imagine having to calculate your money using pounds, shillings, and pence, where 12 pence made a shilling, and 20 shillings made a pound. For a country eager to simplify and modernize its economy, this system felt unnecessarily complicated.

Second, there was a symbolic reason. The Ghanaian pound, while technically ours, still carried the weight of colonial history. It was linked to the British pound sterling and operated within a framework that reminded many of foreign domination. By introducing the cedi, Ghana sought to create a currency that was uniquely its own—a currency that reflected the country’s values, aspirations, and identity.

The Birth of the Cedi

In 1965, under the leadership of Ghana’s first president, Dr. Kwame Nkrumah, the cedi (from the Akan word “sidi,” meaning cowrie shell) was introduced as Ghana’s new currency. The cedi replaced the Ghanaian pound at a rate of one cedi to one pound (£1 = ₵1). The subunit of the cedi was the pesewa, with 100 pesewas making one cedi.

The name itself was significant. Cowrie shells had been a key medium of exchange in Ghana’s pre-colonial trade systems, symbolizing wealth and commerce. By choosing a name rooted in local culture, the government signaled a return to Ghanaian heritage while embracing modernity.

The notes and coins were designed with Ghanaian symbols and images, including cocoa pods, political leaders, and scenes of industrial progress. The idea was to instill a sense of national pride every time a Ghanaian handled money.

The Challenges of Transition

Switching from the Ghanaian pound to the cedi was a massive undertaking. The government had to ensure that people across the country understood the change, so public education campaigns were rolled out. These campaigns explained the new currency system, taught people how to convert their old money, and reassured them of the cedi’s value.

However, the transition wasn’t seamless. Some Ghanaians were skeptical about the cedi’s stability, given that it was no longer tied directly to the British pound sterling. There were also logistical challenges. Distributing the new notes and coins across a country with limited infrastructure was a monumental task.

Perhaps the biggest hurdle, though, was political. The cedi was introduced during a time of growing dissatisfaction with Nkrumah’s government. Critics accused the administration of using the currency change to distract from economic problems, such as declining cocoa prices and rising national debt. There were also whispers of corruption and mismanagement during the transition process, which further fueled public mistrust.

A Currency for Independence

Despite these challenges, the introduction of the cedi marked a significant milestone in Ghana’s journey toward economic independence. It was a currency created by Ghanaians, for Ghanaians, and it signaled a break from colonial traditions.

The cedi also represented Nkrumah’s vision of a modern, industrialized Ghana. On the back of some notes, you could see images of factories and workers—symbols of the president’s dream of transforming Ghana into a leading industrial power in Africa.

But the timing of the cedi’s introduction proved to be both a blessing and a curse. Just a year after its launch, Nkrumah’s government was overthrown in a military coup. The new leadership sought to distance itself from Nkrumah’s policies, and the cedi, though retained, became a silent witness to the political and economic turbulence that followed.

Currency Reforms: The New Cedi (1967)

By 1967, Ghana was undergoing profound changes, both politically and economically. Just two years earlier, in 1965, the country had introduced the cedi to replace the Ghanaian pound as a symbol of independence and modernization. But shortly after this bold move, President Kwame Nkrumah’s government was overthrown in a military coup in February 1966.

The new military-led administration, the National Liberation Council (NLC), viewed the cedi as a symbol of Nkrumah’s regime, which they sought to distance themselves from. However, their concerns went beyond politics. There were practical economic reasons that justified the need for another currency reform. Enter the new cedi—a move that carried hope, skepticism, and significant implications for the economy and people of Ghana.

Why the New Cedi?

One of the first questions people asked in 1967 was: Why replace the cedi so soon after its introduction? The reasons were multifaceted:

- Economic Stabilization: After Nkrumah’s overthrow, the new government inherited an economy in crisis. Ghana’s debt was rising, cocoa prices (a key export) were falling, and inflation was on the rise. The government needed a way to address these economic challenges, and reforming the currency was seen as part of the solution.

- Curbing Corruption and Hoarding: During Nkrumah’s administration, there had been reports of currency hoarding by corrupt officials and black-market operators. The government believed that replacing the cedi would force those holding large amounts of illegal cash to exchange it for the new currency, exposing their hidden wealth.

- Political Symbolism: The NLC wanted to erase traces of Nkrumah’s influence. The cedi, introduced during his presidency, was viewed as a lingering symbol of his administration. By introducing the new cedi, the government hoped to signal a fresh start and their commitment to transparency and accountability.

The Introduction of the New Cedi

In 1967, the new cedi was launched, replacing the original cedi at a ratio of 1 new cedi = 1.2 old cedis. This meant that for every 1.2 old cedis, people received one new cedi in exchange. The slight devaluation was intentional; it was designed to make Ghanaian exports, especially cocoa, more competitive on the global market.

The currency itself underwent significant changes. The notes and coins were redesigned to remove symbols associated with Nkrumah and his government. Instead, the new designs featured neutral and nationalistic symbols, like agricultural produce, industrial scenes, and cultural artifacts, reflecting Ghana’s broader identity.

Public Reaction and Challenges

The announcement of the new cedi was met with mixed reactions. Some people welcomed it, seeing it as a necessary step to stabilize the economy and root out corruption. Others were skeptical, worried about how the transition would affect their savings and day-to-day transactions.

The transition wasn’t smooth for everyone. Rural areas, in particular, faced challenges because of limited access to banks and financial institutions. Many people were confused about how to exchange their old cedis for the new ones, and rumors spread about potential losses during the conversion.

Small business owners and traders were especially concerned. Any sudden change in currency risked disrupting trade, and the slight devaluation of the cedi meant that imported goods became more expensive overnight.

Economic Impact of the New Cedi

While the introduction of the new cedi was aimed at stabilizing the economy, its immediate effects were mixed:

- Tackling Hoarding: The currency reform successfully exposed some hoarded wealth. Those who couldn’t justify their cash holdings were forced to forfeit large sums, as they couldn’t exchange them without raising suspicion.

- Devaluation and Exports: The slight devaluation of the currency made Ghana’s exports, particularly cocoa, more competitive on the global market. However, it also led to an increase in the cost of imported goods, which put pressure on ordinary Ghanaians.

- Public Confidence: The rapid change in currency within just two years eroded public trust. Many people wondered whether another reform might come soon and whether their money was truly safe. This uncertainty created some hesitation in financial transactions and savings.

Economic Instability and Inflation: The Hyperinflation Era (1970s–1980s)

The 1970s and 1980s were a turbulent time for Ghana, a period that tested the resilience of both the nation’s economy and its people. For many Ghanaians, this era is remembered for the relentless rise in the cost of living, queues for basic goods, and the constant worry about what their money could still buy tomorrow. It was a time when the value of the cedi seemed to evaporate before people’s eyes, leaving families, businesses, and the government struggling to make ends meet.

So, how did Ghana, once a shining beacon of economic promise in Africa, descend into such chaos? The answers lie in a combination of global shocks, local mismanagement, and a series of bad decisions that pushed the cedi to the brink of collapse.

The Global Context: A Storm Beyond Our Borders

The 1970s opened with hope, but the world soon plunged into economic turmoil. A series of oil price shocks in 1973 and 1979 sent the cost of energy skyrocketing globally. For Ghana, a country that depended on imported fuel, this was disastrous. The cost of running factories, transporting goods, and powering homes soared.

At the same time, the prices of Ghana’s key exports—cocoa, gold, and timber—fell on the international market. Cocoa, the backbone of the economy, experienced sharp price drops. This left Ghana earning far less foreign exchange, which is the money countries use to trade internationally. Without enough foreign exchange, Ghana couldn’t afford to import essential goods like machinery, medicine, or even rice.

The Local Picture: Bad Policies and a Fragile Cedi

While global factors played a role, the situation was made worse by poor decisions at home. Successive governments tried to solve the problem by printing more money. On the surface, this seemed like a quick fix. After all, if the government needed more money to pay workers or buy imports, why not just print it?

But here’s the problem: printing more money without increasing the country’s production of goods and services only leads to inflation. Inflation is when prices rise because there’s too much money chasing too few goods. And in Ghana during this period, inflation didn’t just creep—it roared.

By the late 1970s, inflation had reached double digits. By the early 1980s, it had spiraled into hyperinflation, with annual rates exceeding 100%. To put that into perspective, if a loaf of bread cost 5 cedis at the start of the year, it might cost 10 cedis or more by the end of the year. For ordinary Ghanaians, this was a nightmare.

Everyday Life During the Hyperinflation Era

The effects of hyperinflation weren’t just numbers on a chart—they were felt in every corner of daily life. Salaries lost their value almost as soon as they were paid. Families found it harder to afford essentials like food, clothing, and rent. Savings evaporated. Those who had money in the bank watched helplessly as its value plummeted.

The black market flourished as people looked for alternative ways to access foreign currencies like the US dollar, which held its value better than the cedi. This only made things worse for the cedi because more people were abandoning it in favor of dollars or pounds.

Queues became a common sight across the country. Whether it was for rice, sugar, or fuel, people often had to wait hours, sometimes days, to buy basic necessities. And even then, they could only purchase limited quantities because of rationing.

For traders and small business owners, pricing goods became a guessing game. By the time they restock their shelves, the cedi had lost so much value that they had to raise prices significantly just to break even. This cycle fed the inflation even further.

The Government’s Response: A Tug of War

The governments of the 1970s and 1980s tried various measures to combat the crisis, but many of these efforts backfired. Price controls were introduced to cap the prices of goods, but this only led to shortages as suppliers stopped selling items they couldn’t make a profit on.

Exchange rate controls were another attempt to stabilize the cedi. The government set official rates for the cedi against foreign currencies, but these rates didn’t reflect the real value of the cedi. As a result, a thriving black market for foreign exchange emerged, where the cedi traded at much lower values.

In 1983, under the leadership of Jerry John Rawlings, Ghana turned to the International Monetary Fund (IMF) for help. This marked the beginning of structural adjustment programs, which included measures like reducing government spending, devaluing the cedi, and liberalizing trade. While these reforms eventually helped stabilize the economy, they came at a significant cost to ordinary Ghanaians, many of whom lost jobs or saw their living standards decline further during the adjustment period.

The Resilience of the Ghanaian Spirit

Despite the hardships of the hyperinflation era, Ghanaians found ways to adapt and survive. Community support systems became even more vital, with families and neighbors sharing resources to get through tough times. Entrepreneurs emerged, finding innovative ways to meet the needs of their communities.

For many, the lessons of this era remain etched in memory: the importance of saving in stable assets, the dangers of poor governance, and the resilience needed to navigate economic uncertainty.

The Fourth Republic and Redenomination (2007)

In 2007, Ghana took a bold step to redefine its economic story—literally. It was a move that stirred conversations in homes, marketplaces, and offices across the country. This was the year the cedi, which had been battered by decades of inflation and economic instability, underwent a dramatic transformation. The Bank of Ghana introduced the redenomination exercise, slashing four zeros off the currency and ushering in what we now know as the Ghana cedi (GHS).

But why did Ghana redenominate its currency? Was it just a cosmetic change, or was it the key to solving deep-seated economic problems? The answers take us back to the years before 2007, when the cedi had become a symbol of economic struggle, and forward into a period of cautious optimism and adjustment.

The Problem: A Currency Weighed Down by Zeroes

By the early 2000s, the Ghanaian economy was on a recovery path after the structural adjustment programs of the 1980s and 1990s. Inflation, which had once reached triple digits, had significantly reduced thanks to tighter fiscal policies and better management of the money supply. But the cedi still bore the scars of those turbulent years.

One major issue was currency degradation. Over the years, inflation had reduced the value of the cedi so much that everyday transactions required carrying large sums of money. For example, a loaf of bread might cost tens of thousands of cedis, while bigger purchases, like a car or a house, involved millions or even billions. This wasn’t just inconvenient; it was a logistical nightmare.

Businesses had to deal with the high cost of printing and handling cash. ATMs couldn’t hold enough money for meaningful withdrawals, and bookkeeping became unnecessarily complicated. Even psychologically, the sheer number of zeros on prices gave the impression that the economy was weaker than it actually was.

The Solution: Redenomination

In 2007, the Bank of Ghana announced a bold solution: the cedi would be redenominated by removing four zeros. This meant that 10,000 old cedis (¢10,000) would now be worth 1 new Ghana cedi (GH₵1). The exchange rate was pegged at 1 Ghana cedi to 1 US dollar, aligning the currency with international standards and making it easier for Ghana to conduct global trade.

The redenomination was not just about cutting zeros. It was part of a broader effort to modernize Ghana’s economy and improve public confidence in the cedi. New notes and coins were introduced, with enhanced security features to prevent counterfeiting. The designs also reflected Ghana’s cultural heritage, with images of significant landmarks, political figures, and traditional symbols.

How It Played Out: The Redenomination Process

The redenomination exercise was rolled out systematically to minimize confusion and ensure a smooth transition:

- Public Awareness Campaign: The Bank of Ghana launched an extensive campaign to educate citizens about the redenomination. Advertisements, posters, and community meetings explained the new currency, its value, and how it would be exchanged for the old cedi.

- Dual Currency Period: For the first six months, both the old and new cedis were used side by side. This allowed people to familiarize themselves with the new notes and coins while gradually phasing out the old currency.

- Exchange Mechanisms: Banks, post offices, and designated outlets were set up across the country to facilitate the exchange of old cedis for new ones. People were encouraged to deposit their old money into bank accounts, which would automatically convert to the new currency.

Public Reaction: Hope, Skepticism, and Adjustment

The reaction to the redenomination was mixed. Many Ghanaians were hopeful, seeing the exercise as a step toward economic stability and modernization. The simplicity of the new currency made transactions easier, especially for businesses. Suddenly, what had been an overwhelming ¢10,000 was now a manageable GH₵1.

However, not everyone was convinced. Some feared the change would cause price increases, as traders might round up prices during the transition. This phenomenon, known as rounding inflation, did occur in some cases, but the government and consumer groups worked to minimize it by monitoring markets and encouraging fair pricing.

For others, the redenomination was symbolic—a shiny new cedi didn’t necessarily mean a shiny new economy. The underlying issues of poverty, unemployment, and debt still loomed large. But for most, the redenomination brought a sense of pride. It was a sign that Ghana was moving forward, leaving behind the economic chaos of the past.

Economic Impact of the Redenomination

The immediate benefits of the redenomination were clear:

- Easier Transactions: With fewer zeros, transactions became simpler. People no longer had to carry large amounts of cash for everyday purchases, and bookkeeping became less cumbersome for businesses.

- Improved Public Confidence: The new Ghana cedi was well-received by the international community, boosting investor confidence and aligning Ghana more closely with global markets.

- Reduced Costs: The cost of printing, handling, and transporting money decreased significantly. ATMs could now hold more meaningful amounts, reducing the frequency of withdrawals.

However, the long-term success of the redenomination depended on Ghana’s ability to maintain economic stability. Inflation, which had driven the need for redenomination in the first place, had to be kept in check.

The Modern Ghanaian Cedi: 2007–Present

The story of the Ghanaian cedi didn’t end with its redenomination in 2007. In fact, that was just the beginning of a new chapter—one marked by opportunities and challenges in equal measure. For many Ghanaians, the new Ghana cedi brought a sense of hope and pride, but as time went on, it became clear that maintaining the value and stability of the currency would require more than just cutting zeros.

In this section, we’ll take a closer look at the journey of the Ghanaian cedi from 2007 to the present day. What has changed, what remains the same, and what lessons can be learned from the currency’s ups and downs?

Post-Redenomination Optimism: The Early Years (2007–2012)

When the redenomination exercise was completed in 2007, the Ghana cedi was pegged at an exchange rate of GH₵1 to USD 1, giving it a strong and competitive position on the global market. This newfound strength boosted confidence among Ghanaians and the international community. For a moment, it felt like the economy was on solid ground.

Ghana was experiencing relatively steady growth at this time, fueled by investments in sectors like agriculture, mining, and infrastructure. The discovery of oil in commercial quantities in 2007 further added to the optimism. Many believed that Ghana was on the brink of an economic transformation, and the stable currency was a key piece of this puzzle.

However, cracks soon began to appear. By 2008, the cedi started to depreciate, losing value against major foreign currencies like the US dollar and British pound. Inflation, which had been brought under control, began creeping back up, and the stability of the new cedi was put to the test.

Challenges of Currency Depreciation (2013–2019)

As the years rolled on, the Ghanaian cedi found itself battling persistent depreciation. The reasons for this were complex but can be broken down into a few key factors:

- Trade Imbalances: Ghana imported far more than it exported, creating a high demand for foreign currencies to pay for goods and services. This demand for dollars and euros put downward pressure on the cedi.

- Public Debt: The government’s borrowing—both domestically and internationally—added to the pressure on the currency. Large debt repayments in foreign currencies drained Ghana’s foreign reserves, further weakening the cedi.

- Global Economic Shocks: External factors, such as fluctuations in oil prices and the strengthening of the US dollar, also affected the cedi’s value.

For ordinary Ghanaians, the impact of depreciation was clear. Imported goods became more expensive, pushing up the cost of living. Businesses, especially those reliant on imports, struggled to keep their prices competitive. And once again, people began to lose confidence in the cedi, turning to foreign currencies as a more stable store of value.

COVID-19 and the Cedi (2020–2021)

The COVID-19 pandemic brought unprecedented challenges to economies around the world, and Ghana was no exception. The government had to spend heavily on healthcare, social interventions, and economic stimulus packages to keep the country afloat. This increased spending, combined with reduced revenue from exports, put additional strain on the cedi.

In 2020, the cedi depreciated by about 3.9%, which was actually lower than in previous years. This was partly because of measures introduced by the Bank of Ghana, including interventions in the foreign exchange market to stabilize the currency. However, inflation remained a concern, as rising food and fuel prices affected households across the country.

Recent Developments: The Struggle for Stability (2022–Present)

The cedi’s value took a dramatic hit in 2022, when it was ranked as one of the world’s worst-performing currencies. Inflation soared past 50%, and the cost of basic goods like food and fuel reached record highs. The situation prompted protests and widespread frustration, as Ghanaians grappled with the rising cost of living.

The government responded with a series of measures, including an agreement with the International Monetary Fund (IMF) for a $3 billion loan program in 2023. This bailout came with strict conditions, such as reducing government spending and improving revenue collection. While these measures have helped stabilize the cedi in the short term, they also come with challenges, including austerity measures that could impact social spending.

A Currency for the Future?

The journey of the Ghanaian cedi from 2007 to today is a story of highs and lows. It’s a reminder that a stable currency is not just about numbers—it’s about trust, governance, and the strength of the economy behind it.

Looking ahead, the future of the cedi will depend on Ghana’s ability to address key challenges, such as:

- Reducing reliance on imports by boosting local production.

- Managing public debt to avoid over-reliance on foreign borrowing.

- Building a more resilient economy that can weather global shocks.

The Digital Economy and the Future of Ghana’s Currency

Imagine walking into a shop, picking up what you need, and paying with just the tap of a card or the scan of your phone. No need to count notes or wait for change. Now picture doing business across borders without worrying about exchanging cedis into dollars or euros. This is not just the future—it’s already happening. The rise of the digital economy is changing how we interact with money in Ghana, and it’s transforming the role of the cedi in ways we never thought possible.

But with all this progress comes big questions: What does a digital economy mean for our currency? Will we one day stop using cash entirely? And how can Ghana ensure the cedi remains relevant in this rapidly changing world?

The Rise of Digital Transactions in Ghana

Over the past decade, Ghana has witnessed a digital revolution. Mobile money services, such as MTN Mobile Money (MoMo), Vodafone Cash, and AirtelTigo Money, have become household names. These services allow people to send, receive, and store money on their phones, making transactions faster and more convenient.

For many Ghanaians, mobile money has been a game-changer. In rural areas where banks are scarce, people can now access basic financial services. It has also made everyday transactions—like paying for groceries, school fees, or utility bills—much easier. By 2021, Ghana had over 18 million active mobile money accounts, handling transactions worth billions of cedis each month.

Digital banking has also seen rapid growth. From apps that allow customers to check their balances to platforms enabling online payments, banks in Ghana are embracing technology to stay relevant. This shift is not just about convenience—it’s about preparing for a future where cash might no longer be king.

The Role of the eCedi

In 2021, the Bank of Ghana made headlines by launching a pilot for the eCedi, Ghana’s digital currency. This move put Ghana among the first countries in Africa to explore a Central Bank Digital Currency (CBDC). But what exactly is the eCedi, and why is it important?

The eCedi is not a cryptocurrency like Bitcoin. Instead, it is a digital version of the Ghana cedi, issued and regulated by the Bank of Ghana. Unlike mobile money, which relies on private companies, the eCedi is directly tied to the central bank, making it safer and more secure.

The eCedi has several potential benefits:

- Financial Inclusion: By making it easier for people without bank accounts to access digital money, the eCedi could help bring more Ghanaians into the formal financial system.

- Efficiency: Digital transactions are faster and cheaper than handling cash, especially for businesses.

- Cross-Border Trade: In the future, the eCedi could make it easier for Ghanaian businesses to trade with other countries without relying on foreign currencies.

But the eCedi also raises concerns. How will it affect traditional banks? Will it be secure from cyberattacks? And how will the government ensure that people understand and trust this new form of money?

The Challenges of a Digital Economy

As exciting as the digital economy is, it comes with its own set of challenges.

- Cybersecurity Risks: As more money moves online, the risk of cybercrime increases. Fraudsters are always looking for ways to exploit digital systems, and Ghana will need strong protections to keep the eCedi and other digital platforms safe.

- Access and Education: While urban areas are embracing digital payments, rural areas still face challenges like poor internet connectivity and lack of understanding about digital tools. The government and private sector will need to work together to bridge this gap.

- Dependence on Technology: What happens during a power outage or when a digital system goes down? Ghana’s digital economy will need backup systems to ensure that people can still access their money in emergencies.

- Regulation: The rapid growth of digital payments has created new regulatory challenges. The government will need to strike a balance between encouraging innovation and protecting consumers.

The Future of the Cedi in a Digital World

As Ghana moves further into the digital age, the role of the physical cedi is likely to change. Cash may not disappear entirely, but its importance will likely diminish as more people adopt digital payments. This raises important questions about how the cedi can remain relevant:

- Strengthening Trust: For the cedi—whether physical or digital—to remain strong, Ghanaians must trust its value. This means keeping inflation under control and ensuring the currency is backed by a stable economy.

- Integration with Global Systems: As trade becomes more global, the cedi will need to integrate with international payment systems. The eCedi could play a key role here, making it easier for Ghanaian businesses to operate on a global scale.

- Innovation: The Bank of Ghana and financial institutions must continue to innovate, ensuring that the cedi keeps pace with changing technologies and consumer needs.

A Balancing Act

The rise of the digital economy is a double-edged sword. On one hand, it offers Ghana incredible opportunities to modernize its financial system, reduce inefficiencies, and empower its people. On the other hand, it presents significant challenges that must be carefully managed to ensure the benefits are shared by all Ghanaians.

The future of the cedi—both physical and digital—will depend on Ghana’s ability to adapt to this new reality. As we look ahead, one thing is clear: the cedi is not just a medium of exchange. It is a symbol of our identity, our resilience, and our aspirations as a nation. How we manage its evolution will shape not just our economy but also our place in the world.

Conclusion and Final Thoughts

The introduction of the eCedi and the growth of digital transactions represent a bold step into the future. Yet, this transformation comes with responsibilities. As we embrace technology, we must ensure that no one is left behind. Rural communities, small businesses, and the less tech-savvy must all have access to and trust in the digital financial system.

Moreover, the stability of the cedi, both physical and digital, depends on sound economic policies, efficient governance, and a collective effort to reduce dependency on imports while boosting local productivity. If managed well, the cedi can become more than just a currency—it can serve as a tool for economic empowerment and a symbol of national pride.

SOURCES:

Ghana Month: From cowries to cedis – How Ghana’s currency has changed over the years

Evolution of the Local Currency

GHC (Ghanaian Cedi): What it Means, How it Works, Influences

This is really a very insightful article.

Very detailed and rich. Thanks Ibn Ba’z

Thanks for reading and I’m glad you like it. Please share as well 🙏